In the latest version of coog, coopengo announced the start of the development of collective health and provident contributions. In coog 22.41, the call mode for these self-billed collective contributions is now finalized!

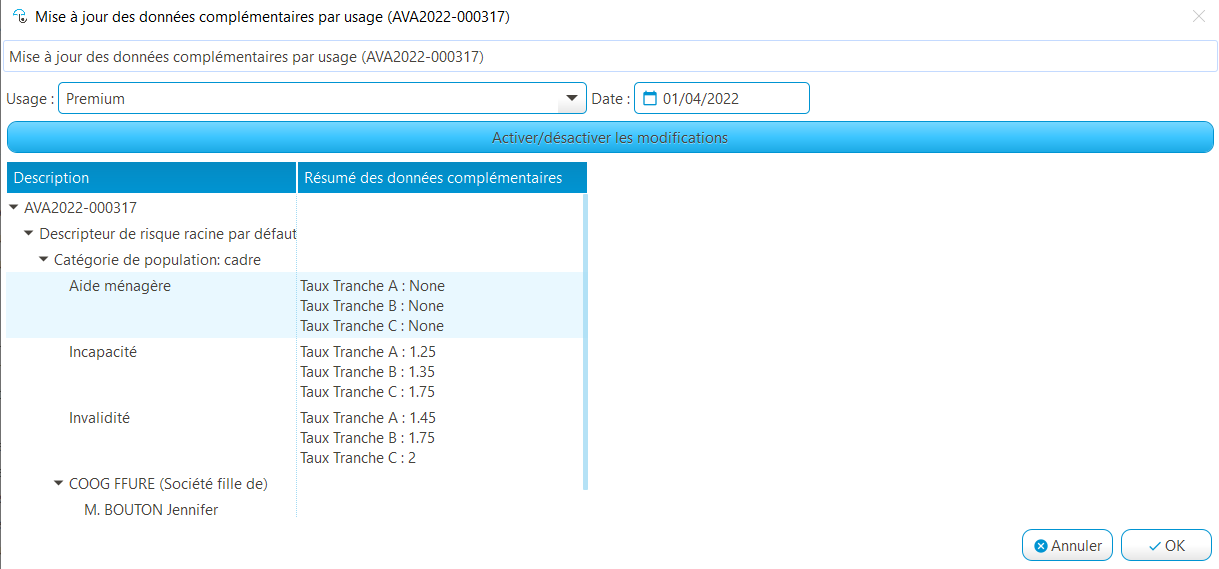

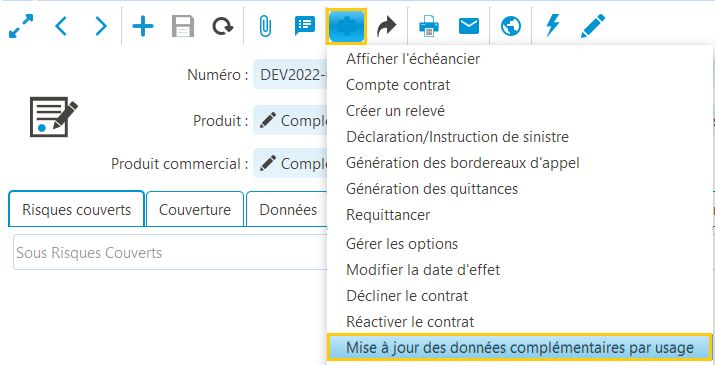

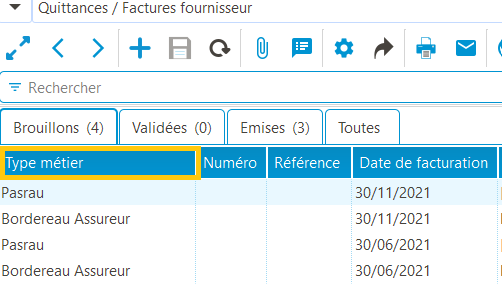

We have added the notion of call mode to the product and contract levels. New call modes have been created, such as the blank contribution call and the self-billing call. The latter allows the calculation of receipts based on actual collections. The data communicated is adjusted at the end of the year.

Two other particularly useful new features, covering both individual and group business, for all business lines (Loan Insurance, Health and Personal Protection):

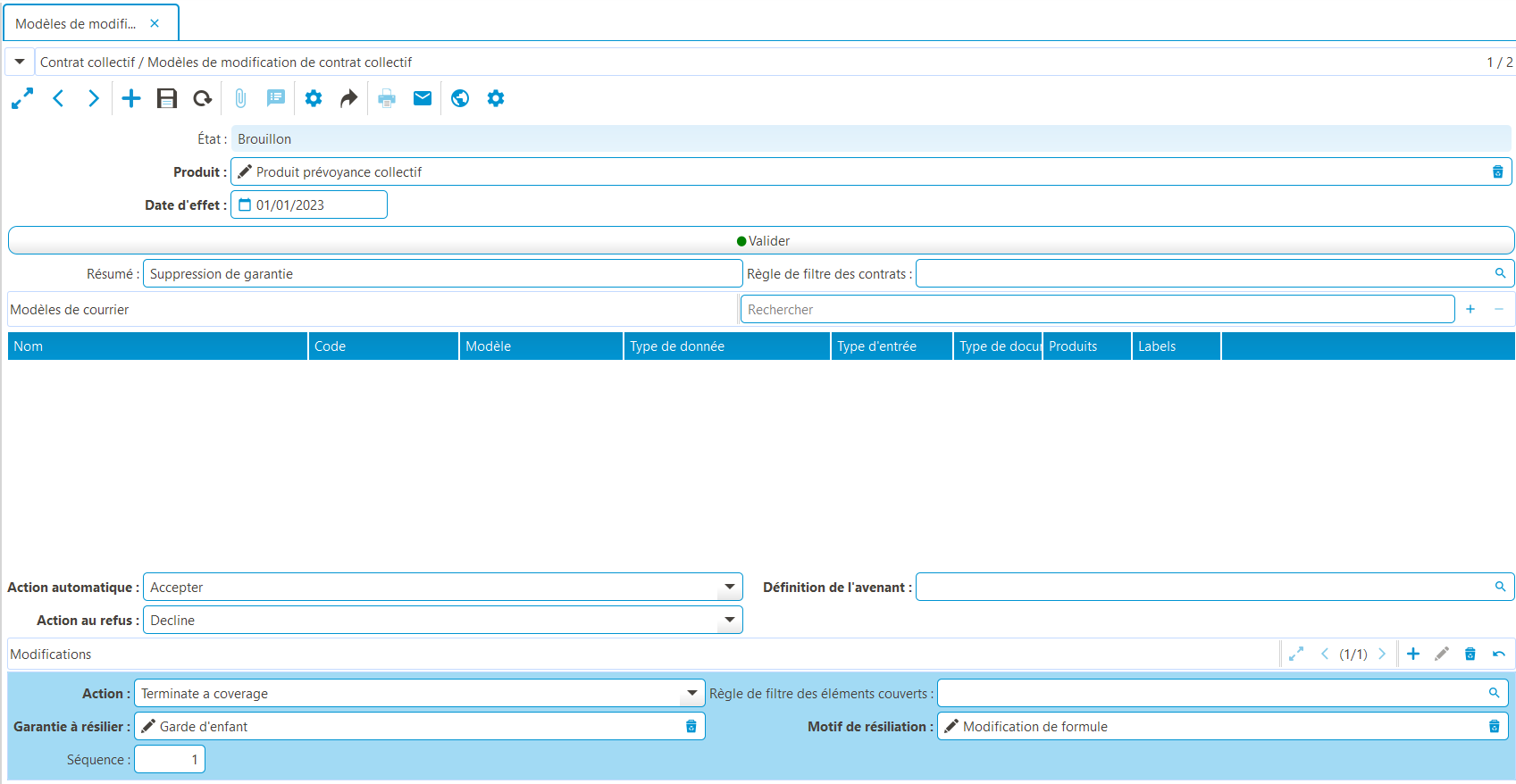

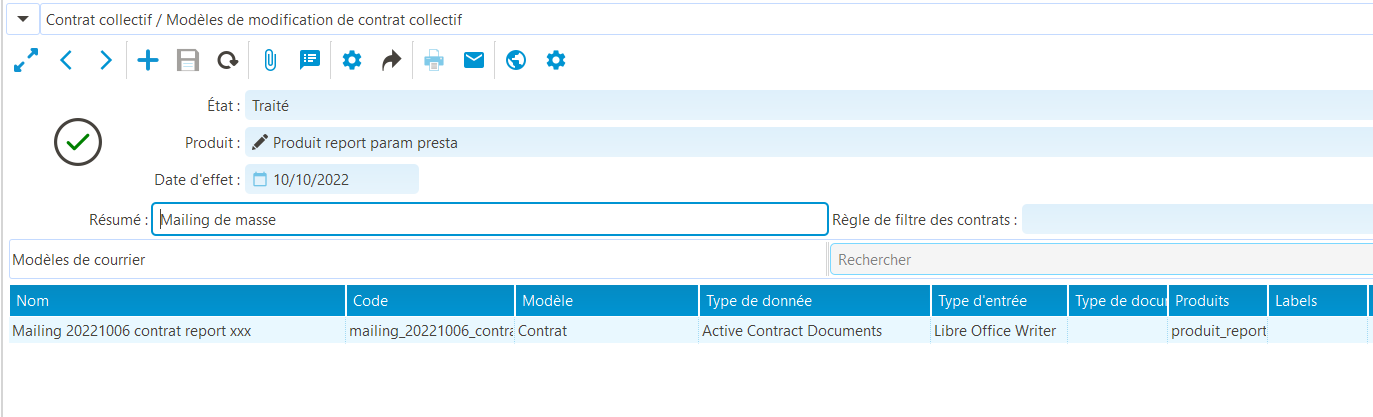

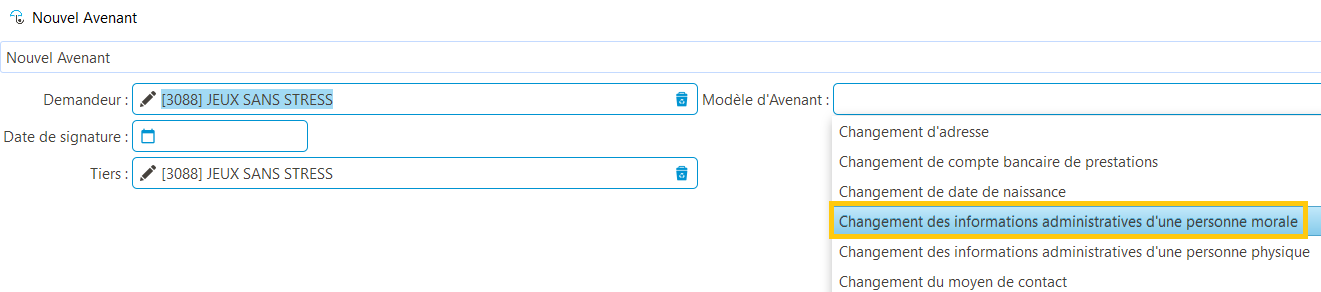

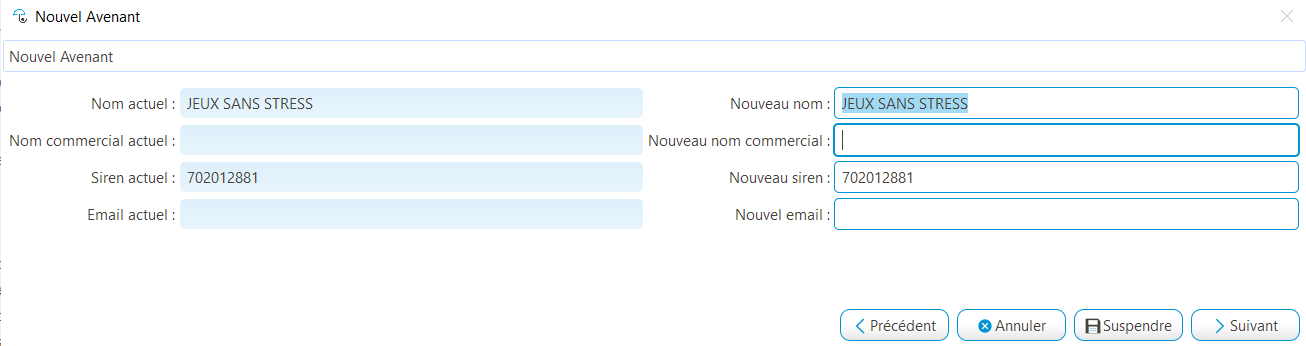

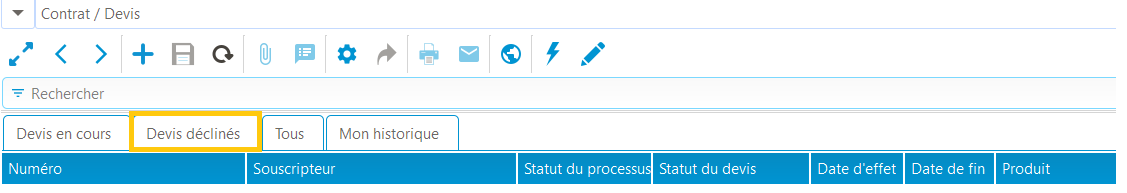

- Generate and apply amendments en masse without having to go through each individual contract, thanks to the new contract amendment template,

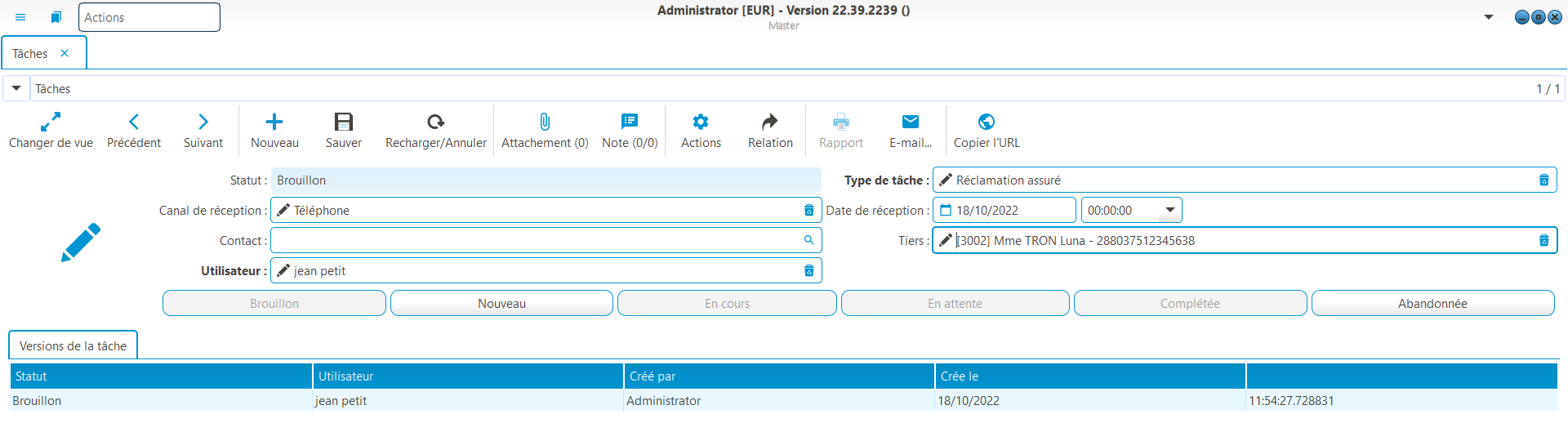

- Create a task manually and assign it to a coog user with the creation of the task mechanics module.

Oct. 14, 2022 Release notes

coog Back-Office

Product settings

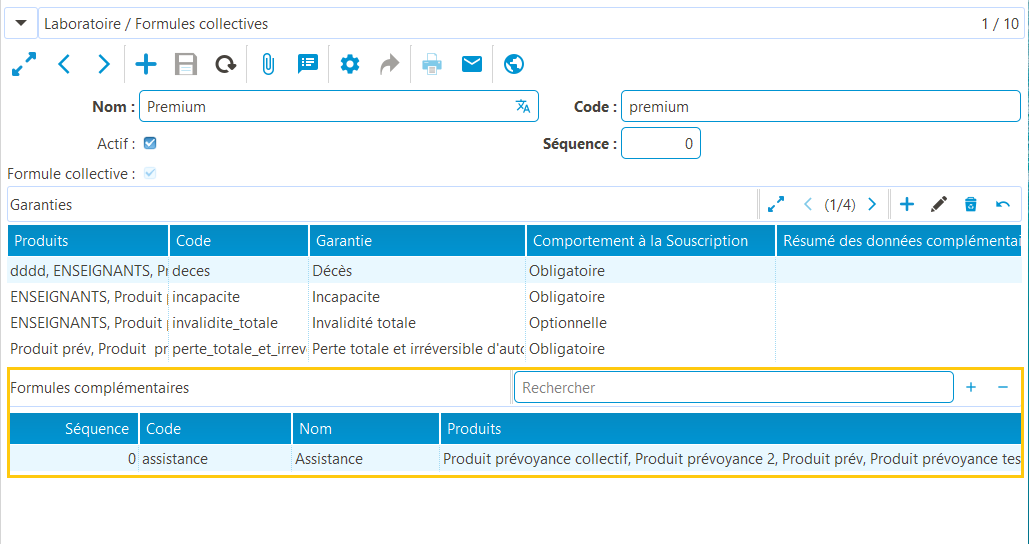

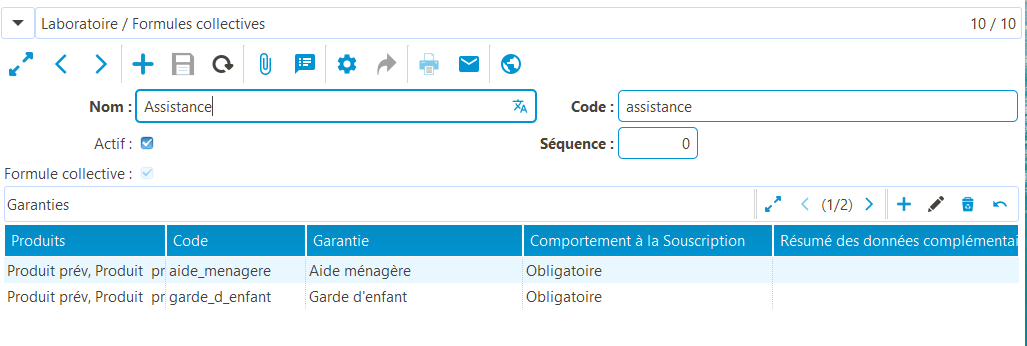

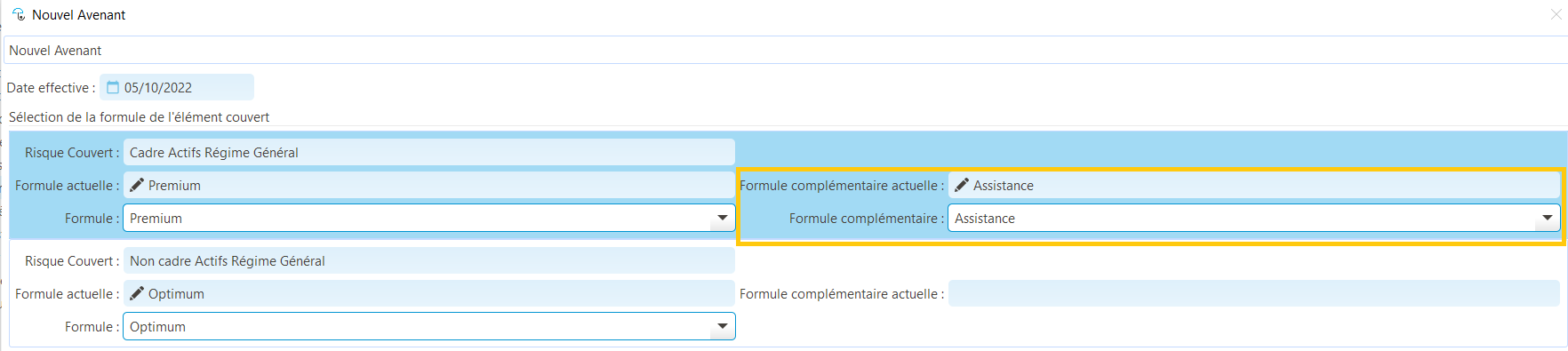

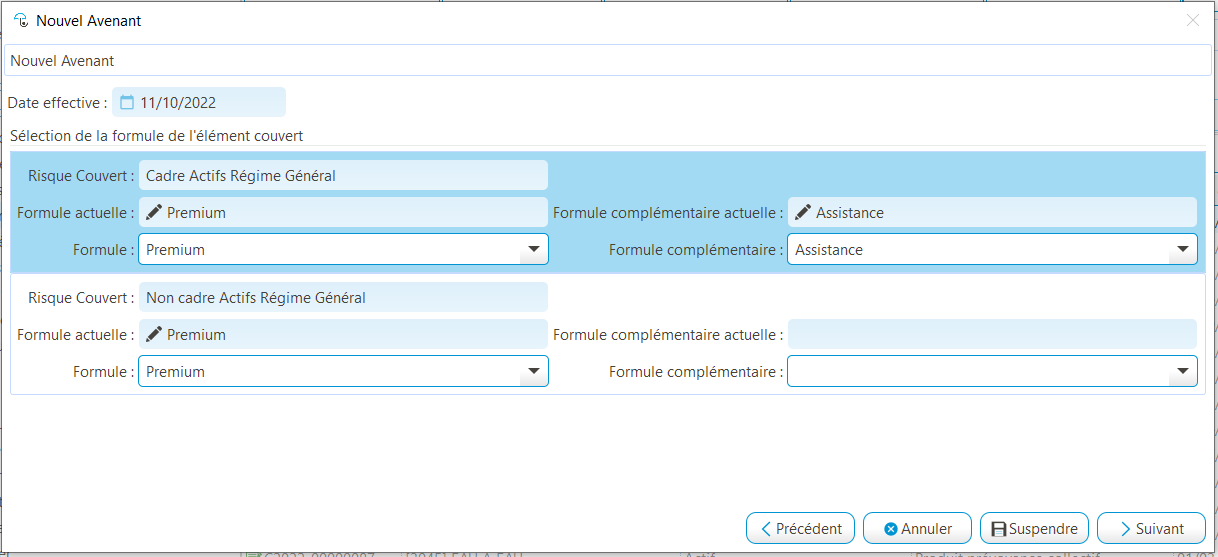

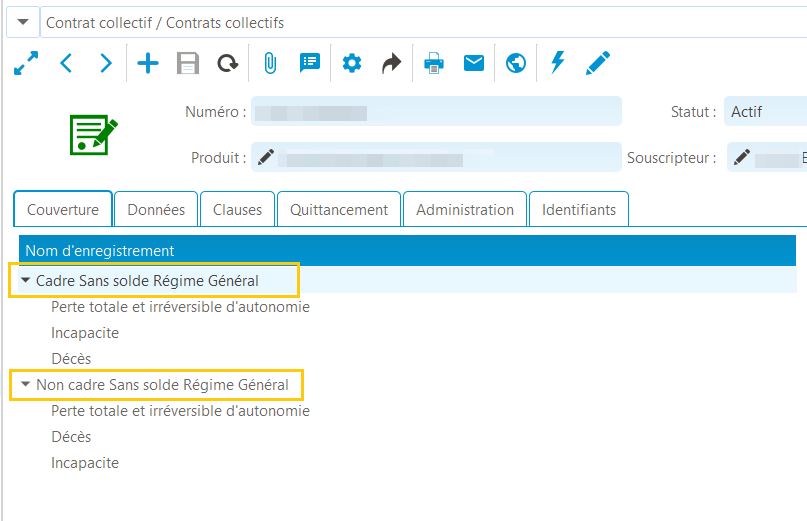

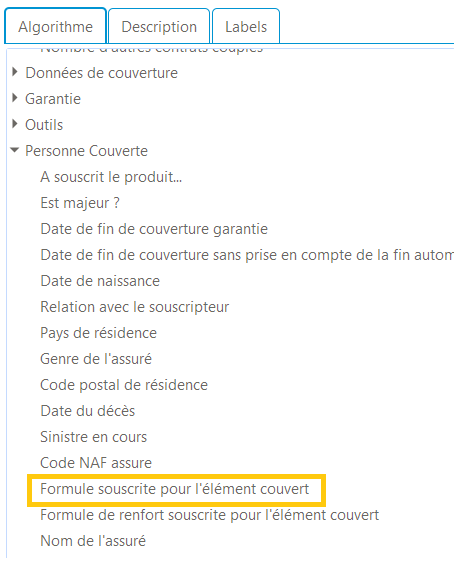

- When setting up formulas in a product, it is now possible to set up complementary formulas. In coog, either the product has no formulas and the user assembles the coverages himself, or the product has formulas and the administrator must subscribe to a formula. And a formula can entitle the user to subscribe to a complementary formula.

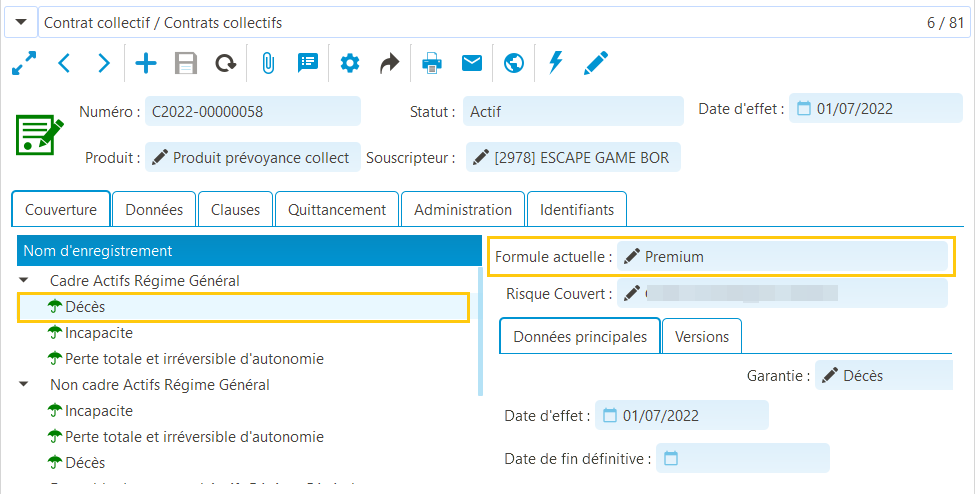

- In the example below, the Premium plan contains three mandatory benefits (Death, Disability and Permanent disability) and one optional benefit (Total disability). This Premium package entitles the policyholder to subscribe to a complementary assistance package that includes domestic help and childcare.

To sum up, coog 22.41 allows you to add, validate and subscribe to complementary formulas, not forgetting the evolution of the formula management rider.

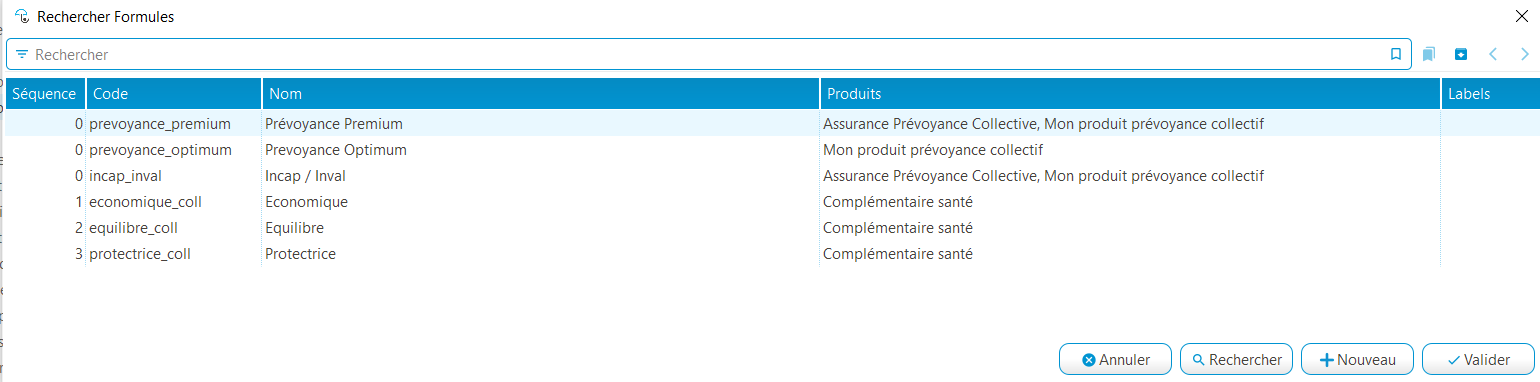

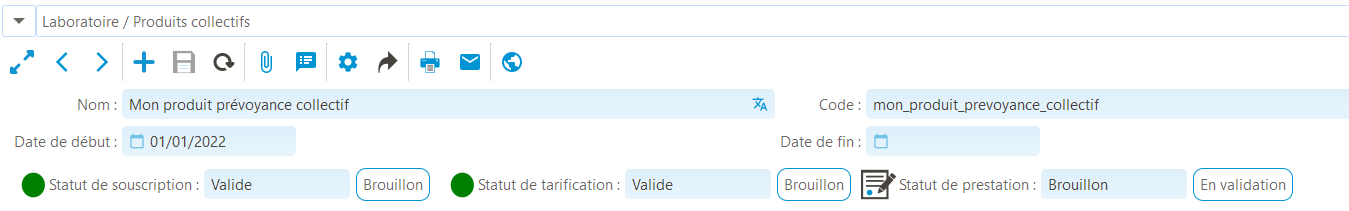

- A filter has been added to the formulas in the Product Lab to prevent the display of formulas linked to products other than group products: the screen only displays formulas linked to group products.

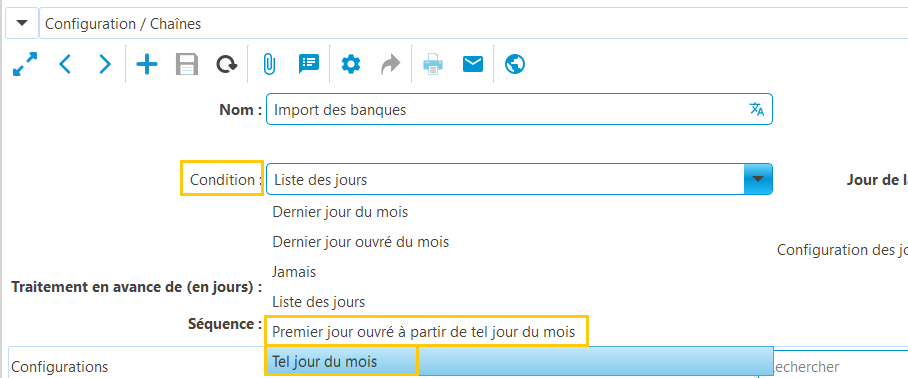

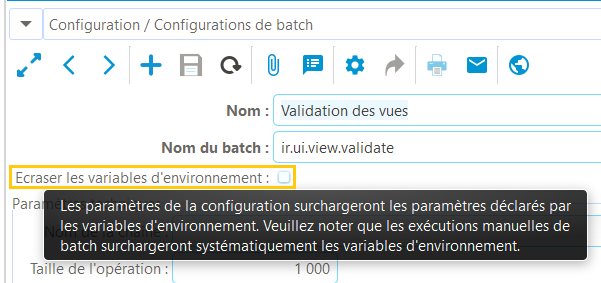

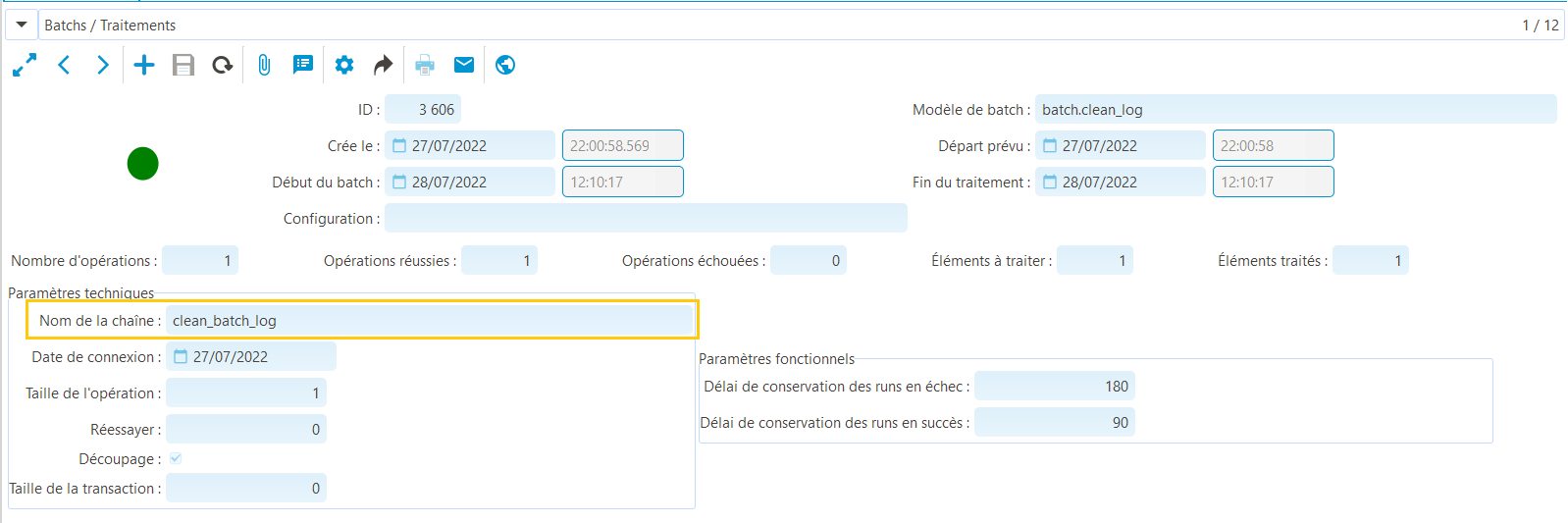

- Addition of a processing completion method at the end of batch runs/chains/batch plans.

- Simplified batch status fields

- It is now possible to launch batch chains from within the application, transforming the daily chain into a task.

- Added batch configurations for pre-payment returns.

- Added batch for managing the creation, validation and issue of call slips.

- The recalculation endorsement batch can now be run in parallel: receipts are cancelled but not recreated. Receipts must be created and issued via dedicated batches.

Security

- As solution administrator, set up automatic password expiry and minimum password complexity to guarantee maximum security for access to the coog Back-Office.

RGPD

- Access control models are now technically historized.

coog-API

- v1 APIs are deprecated as of version 22.41, in favor of GraphQL lookup APIs. They will be permanently removed as of coog 23.14 (next major release). The reasons for this change are as follows:

- Strong dependency on the data model, which introduces the risk of regression when updating the Back-Office application,

- Impossibility of consulting data “in depth”, which implies a multiplication of calls to retrieve all the desired data, and therefore inadequate performance,

- For modifications, risk of incomplete processing of requested changes due to the absence of a transactional process.

- The use of GraphQL for data queries addresses all three of these issues. The functional scope currently available, which has been gradually built up since coog version 2.8, covers standard requirements, including in particular the creation of a “policyholder space” website (consultation of contracts, payment deadlines, etc.). For modification / simulation operations, the corresponding APIs have been implemented in API v2.

Please contact your account manager to discuss the changes to be made to the APIs for your next version upgrade.

- Change database from Redis to MongoDB for architecture purposes.

- Pass without action an endorsement and expose this endorsement data via API.

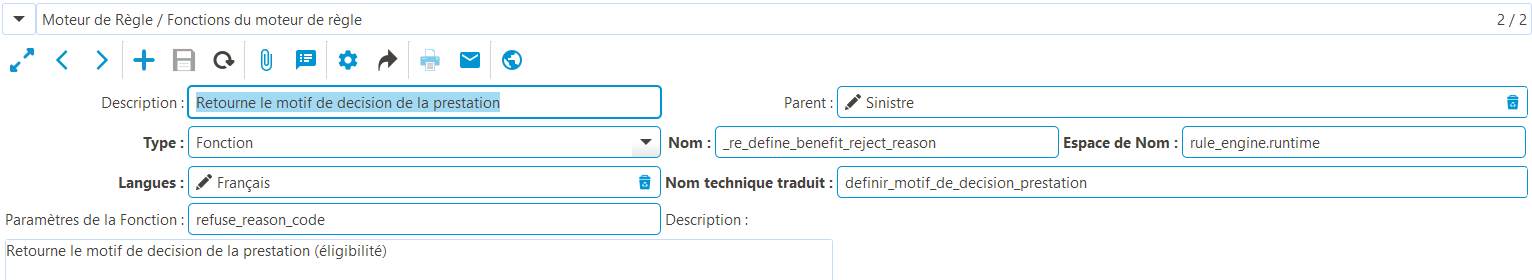

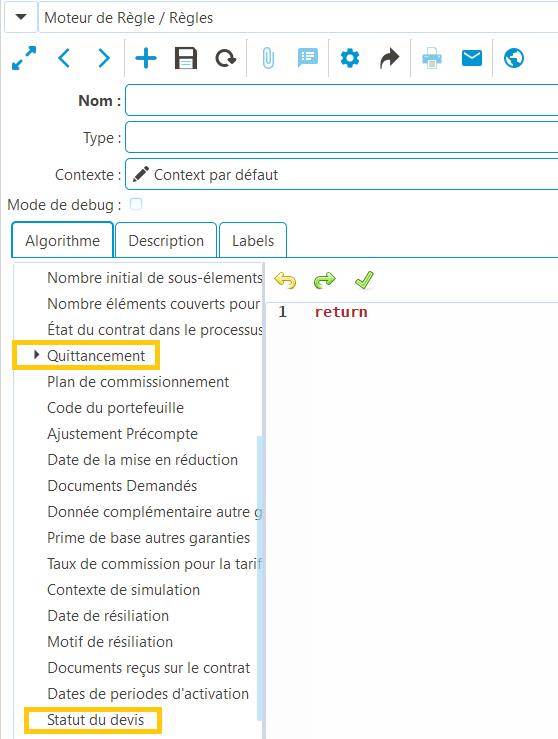

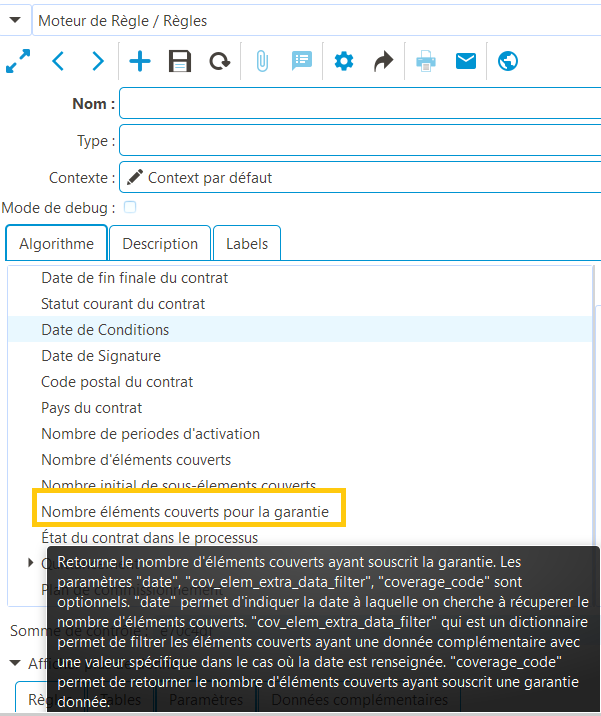

- Execute the coverage amount rule for a warranty, when this does not depend on contract information: this enables the Front user to select the coverage amount proposed for a warranty.

- Enhanced the configuration of our partner Paybox by Verifone’s secure payment service with the addition of payment redirection URLs (success, refusal and cancellation).

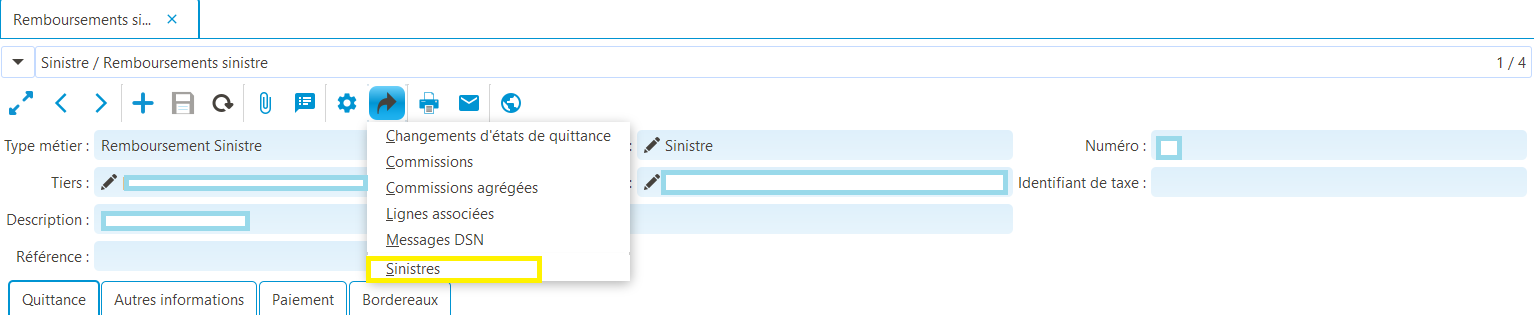

- Creation of an API for manual statement creation.

- Enable queries on benefit bank account endorsements via the GraphQL API.

- Added filter criteria to GraphQL calls in the distributor area (B2B): it is now possible to refine the search for a third party by filtering on the basis of the insured’s surname, first name, date of birth and Social Security number. In this case, the search must return only one third party. A consistency check has been set up to detect an error if more than one third party is returned. The search must be performed as follows:

- With code only

- Call with Last name, First name, Date of birth

- Call with Social Security Number

- Call with Social Security number, First name, Date of birth

- Addition of risk analysis fields for the GraphQL API in the distributor space (B2B).

- Enrichment of the policyholder area (B2C) GraphQL: addition of payment types available for a contract: a new method has been added for the payment creation API so that coog can choose the dematerialized payment method for a contract.

- Extraction of additional quote details in API.

- Fields added for GraphQL API in B2B distributor space: document lines requested.

- Manage additional loan-to-value data in API for Loan Insurance.

- Enable queries on discharge information endorsements via the GraphQL API.