COOG Back Office

Third-party repository management

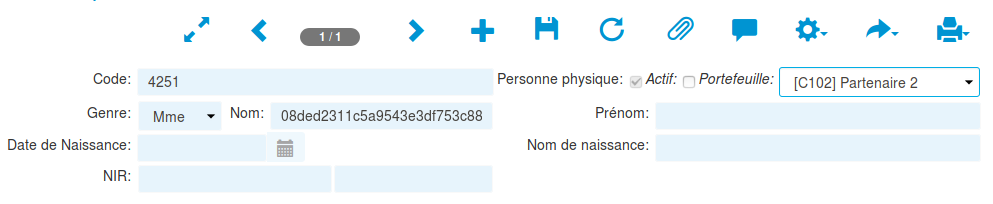

RGPD: Wizard for anonymizing an individual to enable him or her to exercise the right to be forgotten. coog encrypts all data relating to the individual concerned. Anonymization is only possible after automatic verification of the minimum retention period after termination of a contract (defined by product), payment of receipts, etc.