This new version of the Back-Office includes major developments in contract management, contribution deduction and new reporting features.

On the Front-Office side, coog also enhances the user experience of the B2B portal, integrating, for example, the addition of Microsoft Azure authentication.

coog version 2.8 released

coog Back-Office

Third-party repository management

- Manage a person’s date of death.

- Addition of country and department fields on a job.

- Added data for French public service employees.

- Management of additional third-party data: Until now, the only way to add additional data on a third party was to use data of the covered risk type. This behavior was used, but was not optimal. coog now manages additional data for both natural and legal persons. In addition, coog used to systematically store additional data of the insured risk type on the corresponding third party, which could be practical in some cases (smoker information, for example) but not necessarily in all cases. This behavior is now optional and deactivated by default, but does not change the behavior of existing customers. It is now possible to add additional data on a policyholder (physical or moral) and not just the insured, and store the configuration on the associated product.

- Updated fields in a third-party RGPD extraction.

Third-party API

- Third-party birth data added to APIs.

- Enable birth name to be entered via APIs.

- Management of Siren in third-party APIs.

Contract management

- New module: Contract details (contract_extra_details) :

- Products can contain a rule that will be used to calculate the detail values of subscribed contracts.

- Underwritten contracts display the “current” value of the details for quick access to information.

- New module: Dependants (contract_life_dependents):

- Enable the entry of a list of dependents on the covered items authorized by the risk descriptor.

- Dependents are defined by a start date, an end date and a third party.

- Guarantee formulas can be ordered.

- Addition of an underwriting behavior rule to define whether a benefit is compulsory or optional according to a parameterized algorithm (for example: it becomes possible to make a benefit optional or compulsory according to the age of the policyholder).

- Addition of shared options at the covered item level.

API Contract

- Verification of additional data in APIs is differentiated by API.

- Specification of the need for additional data in the APIs.

- Calculation of the coverage amount and return to the API.

- Management of subscriptability in APIs.

- Do not return the list of values for a coverage amount in the product description API if its rule uses additional data (e.g. person data).

- Calculate coverage amount and return to API.

- Adds covered risk information to the simulate API.

- Retrieves additional third-party data from the third-party creation API.

- Added discount rate to simulate API return.

- Added an option to return a summary only of the first non-zero receipt in the simulate API.

- Added commercial discount information to the simulate API .

- Added commercial discounts to the subscription API.

- Product Description API, change location of risk descriptor options.

- Extraction of eligibility information in the simulate API.

- Added distinction between fields required for quotes and fields required for underwriting in the Product Description API.

- Filtering of additional data forced by formulas in the Product Description API.

- Possibility of modifying contract fees via APIs.

Risk analysis

- Add deferment date to risk analysis.

- Management of several risk analyses for one contract.

- New comment field on surcharges to differentiate surcharges for the same type of risk (Sports Risk – Scuba Diving/Sports Risk – Motor Racing).

- Added fee note management.

- Waiver of fee note ceilings.

Borrower

- Added access to loan-to-value ratios at a given date in the rules engine.

- Added the ability to enter outstanding amount information in the app and API.

- Added a function to retrieve the loan-to-value ratio of another collateral in the rules engine.

- Added a field to identify contracts with common loans.

- Ability to calculate premiums on loan anniversary (useful when the loan release date is not synchronized with the contract effective date).

- Include the total amount of the loan in the outstanding amount calculation when the loan has not yet been released. Managed via an option in the rule engine so as not to change existing behavior.

API borrower

- Bank charges added to API loans.

- Additional data can be entered and accessed via APIs.

Contract Endorsement

- Addition of a rider allowing the cancellation or subscription of predefined options.

- Addition of a rider to manage the transition to retirement.

Product distribution

- Display contact information for distribution networks in the application.

API product distribution

- Add an API that lists the commercial products available to a user.

- Distribution network overloaded by API identity.

- API implementation: update distribution networks.

- New APIs for modifying third-party information on a distribution network and for closing a distribution network (linked to a commission plan).

Claims

- Deliver default configurations for loss and event descriptions.

- Enable files to be closed with the new status of ‘no further action’.

- Manage revaluation of indemnities over deduction periods.

- Activate blocking sub-status for reopened status.

- Generate a claims document template from a payment group or receipt.

- Addition to the rules engine of a function returning the total amount compensated (paid/validated) for a covered person and a benefit over the current term.

- Manage contract eligibility based on current claims.

- Predefine parameters for managing public-sector work stoppages (CMO, CLM, etc.).

- Correction of AGIRC and ARRCO dates and addition of the merged table.

Cotisation

- Ajout des réductions commerciales automatiques et limitées dans le temps.

- Nouvelle possibilité dans les règles de calcul des dates de primes pour pouvoir se synchroniser mensuellement par rapport à une date paramétrée.

- Possibilité de configurer un montant maximum pour la surcharge des frais.

- Réutilisation des tarifs calculés pour d’autres garanties.

- Permettre de sélectionner les quittances de la date de fin de la dernière quittance payée à la date de fin de la dernière quittance.

- Ajout d’un batch de lettrage automatique.

- Déplacement de la configuration du prorata des primes sur les produits.

- Génération des données d’échéancier de paiement sur un tiers à des fins d’impression.

- Ajout d’un batch de calcul des primes à partir d’une certaine date.

- Nouveau module Création des batches de précompte : Calcule les fichiers batch de précomptes pour les retraités et employés de la Fonction Publique.

Contribution

- Automatic, time-limited commercial discounts added.

- New option in premium date calculation rules to synchronize monthly with a set date.

- Possibility of configuring a maximum amount for fee surcharges.

- Reuse of rates calculated for other benefits.

- Enable selection of receipts from the end date of the last paid receipt to the end date of the last receipt.

- Added an automatic lettering batch.

- Moved premium prorating configuration on products.

- Generated payment schedule data on a third party for printing purposes.

- Added a batch for calculating premiums from a certain date.

- New module Creation of deduction batches: calculates prepayment batch files for pensioners and civil servants.

Cotisation API

- Ajout d’une option pour ne retourner un résumé que de la première quittance non nulle dans l’API simulate.

- Ajoute les informations de quittancement dans l’API simulate.

- Ajout d’une API de tarification dans le backoffice.

API contribution

- Added an option to return a summary only of the first non-zero receipt in the simulate API.

- Add release information to simulate API.

- Added a pricing API to the Back-Office.

Collection – Disbursement

- Batch import of banks.

- Notify payment group acknowledgement event.

- Trigger a Paybox payment on contract activation, even if the payment method is not Paybox.

- Configure SEPA file output folder according to log.

- Add a constraint on the SEPA mandate signature date.

- Set the date of the new receipt information to the day after the date of the last paid receipt when switching to manual mode after a payment rejection.

- Bank repository integration using “Swift” format.

Accounting

- Generate accounting file with column names.

- Management of debt assumption by a third-party organization.

Commission

- Added the possibility of varying the commission rate per contract for a contributor (within the limits authorized by the parameters).

API commission

- Enable API subscription without specifying an agent if the commercial product does not require one.

- Added two APIs for closing and reopening distribution networks.

Health

- almerys indus batch added.

- Addition of a function in the rules engine to access the number of covered third parties linked by a relationship to the subscriber under an age limit.

- Address management in the almerys V3 flow, where addresses are mandatory via default values.

- Addition of commune of birth and member number to almerys V3 batch.

- Create delegation periods only within the start date – end date range of the associated option.

- Hide the delegation periods tab on options if the corresponding benefit does not have a delegate protocol.

API Health

- The SSN is only required for underwriting via API if the risk descriptor requires it.

- API, Third-party birth rank management.

Desktop publishing

- Added settings for actions by event type to filter on target objects rather than events.

- Enable multiple coog report templates using the same BDOC template.

- Print a document via a web service call to BDOC web.

- Add paper forms to be completed as attachments in the parts request e-mail.

- Enable multiple attachments to be attached to document requests, and historicize them.

- Possibility to request a customized document.

- Enable manual document requests.

- Added a button for invalidating attachments.

- Possibility of splitting the electronic signature process into two stages. Generate document and send to supplier. An option has been added to the electronic service configuration to switch to manual mode. Once the document has been generated, the manager can check its content before manually triggering the process.

- Dynamic bundle management by merging only the documents required. It is therefore possible to add n documents in the definition of a bundle, but they will only be added if they are really required for the current file.

- Ability to view/add products from mail templates.

- Ability to filter document types by product. Useful when a manager wants to request a new required document by filtering by product.

- Add a list of mail templates to questionnaires.

- Automatic activation of a contract on confirmation of electronic signature.

Technical API

- Addition of a technical API for document generation.

Rules engine

- Added a wizard to clean up traces in the rules engine.

- Added a “create date” function to the rules engine.

Cross-functional features

- Add dynamically evaluated web resources to document descriptions.

- Added multi-selection additional data.

- Addition of a tab in complementary data to display the list of web resources.

Web

- Sales route contracting.

- Evaluation of web resources by genshi.

- Addition of binary values for Front End resources.

- Addition of additional data groups in questionnaire sections.

Technical core

- Consumer APIs delegated to Celery.

- Added a password change API.

- Allows old jobs to be deleted when a batch is run.

- Added a line in the batch report when a batch has not generated any jobs.

- Azure active directory identity added.

- Smart cache added to configuration objects.

- SSL connection to migration source database.

- Group bank accounts that require processing one by one.

- New Reporting Frameworkmodule: Add a framework for easy reporting/extraction.

Front-Office coog

Portal: B2B

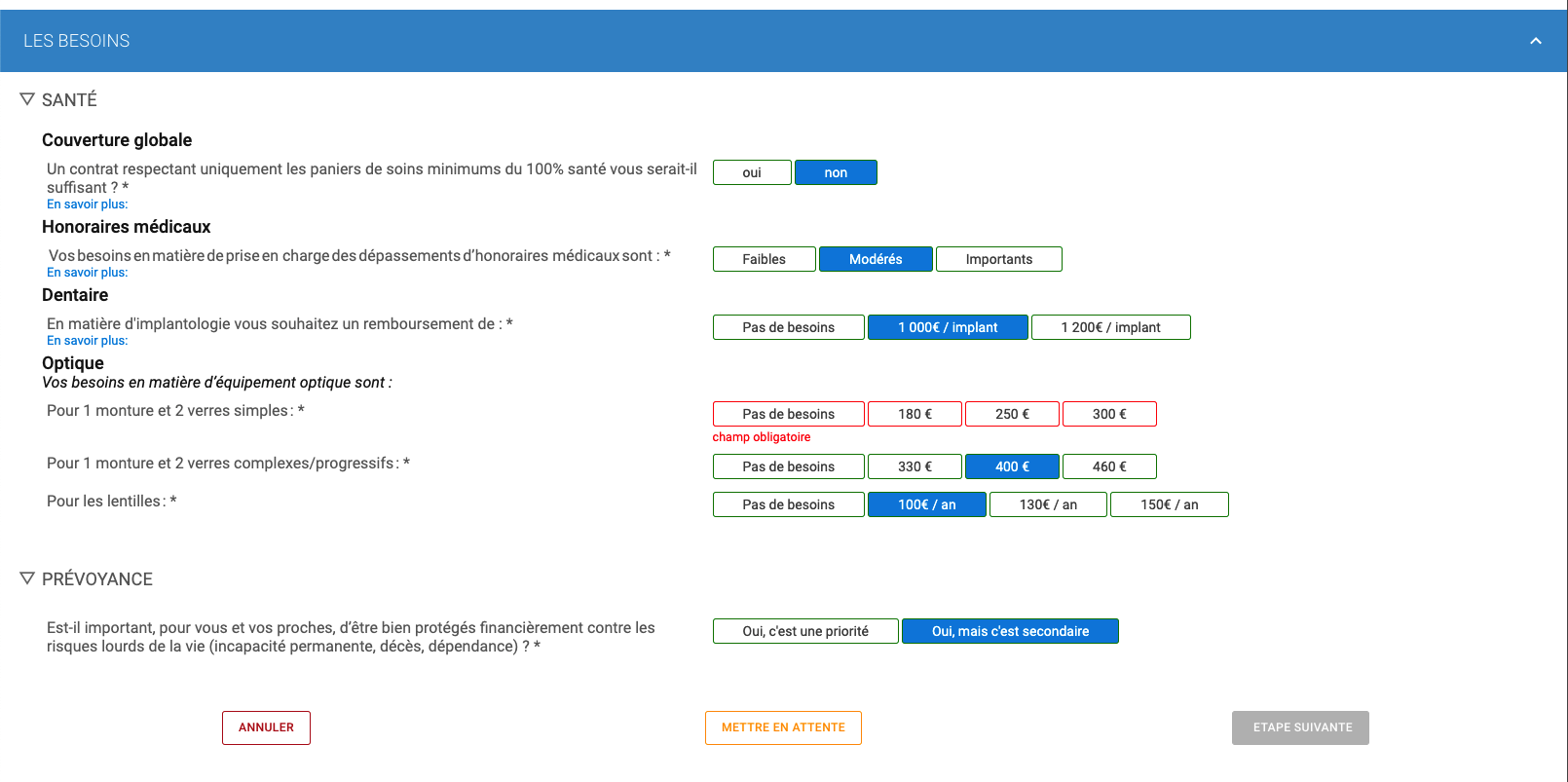

DDA questionnaire: functional and ergonomic improvements

- Support for multiple questionnaires for combined product offers.

- New fields added:

- Multiple selection field.

- Button-type selection field.

- Support for nested fields and field groups.

- Support for labels, descriptions and help on groups and fields.

- Dynamic validation of fields and available actions.

- Generation of the advice assignment form.

- Full integration into the sales process.

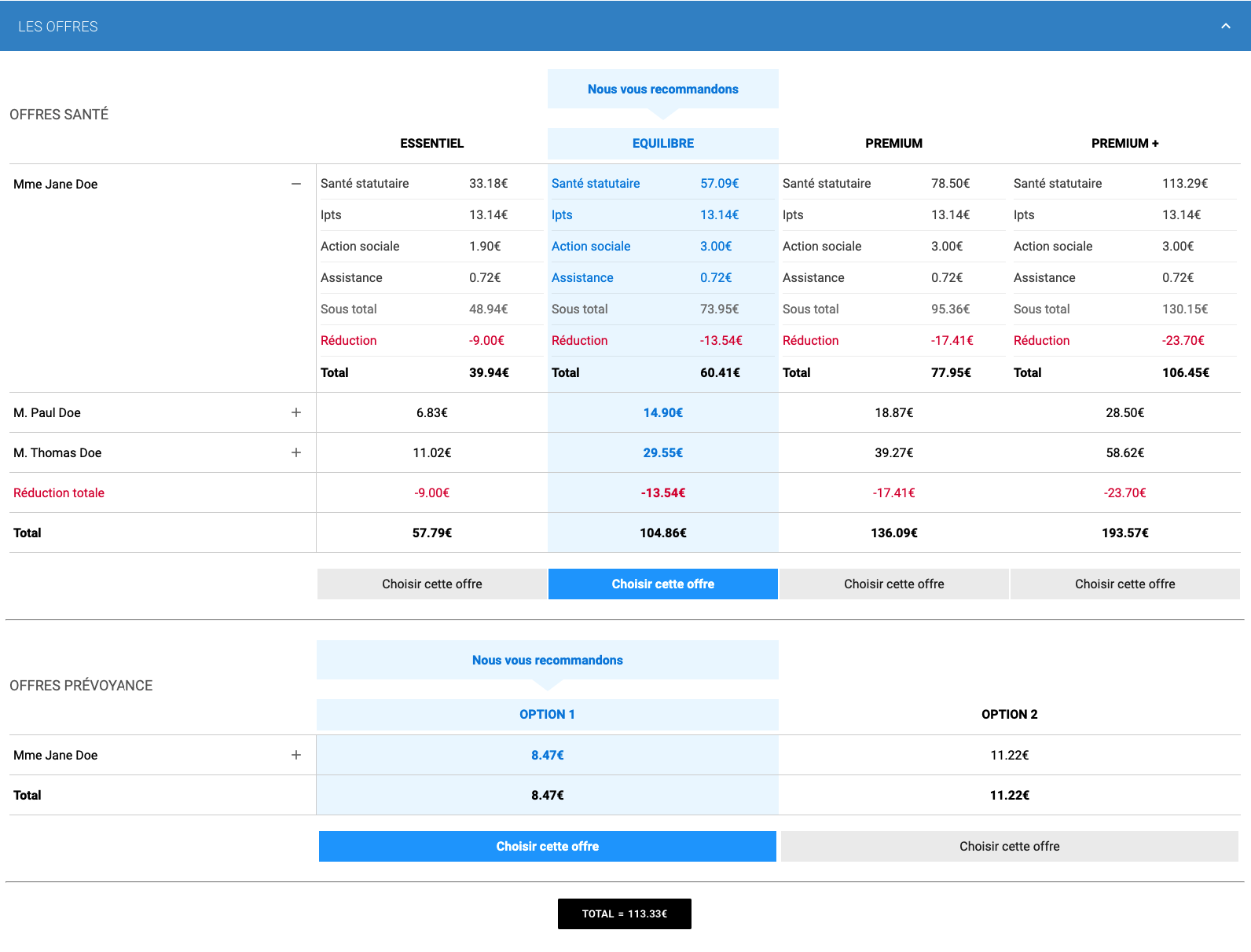

Offer display: completely redesigned to provide a more complete and ergonomic display

- Podium-style display with the ability to compare multiple offers simultaneously.

- Simplified compact view and extended view for more detailed information.

- Option to select one or more offers, in the case of combined offers, in order to create the related quote(s).

SSO authentication: added support for Microsoft Azure authentication via OAuth 2

API

Parcours de vente : SalesRoute

- Gestion de la tarification simultanée de plusieurs offres.

- Cloisonnement de la liste en fonction de l’utilisateur.

- Gestion des réductions commerciales.

- Gestion de l’édition des documents relatifs à un parcours de vente.

- Initialisation des tarifications en fonction du résultat du questionnaire.

API

SalesRoute : SalesRoute

- Simultaneous pricing management for multiple offers.

- List partitioning by user.

- Sales discount management.

- Management of sales route documents.

- Pricing initialization based on questionnaire results.

Products

- Search for commercial products.

Broker

- Add actions for opening, closing and reopening distribution networks.

Web resource

- Added web resource search.

Identity manager

- oog: basic login/password authentication and token authentication with identity model management.

Gateway

- Account: Delegation of identity management to the corresponding service.

- OAuth: Add Azure Active Directory authentication via OAuth 2.

- Service: Get service information (url, status, version, etc.).

Repository service

- Lender: Lender repository added.